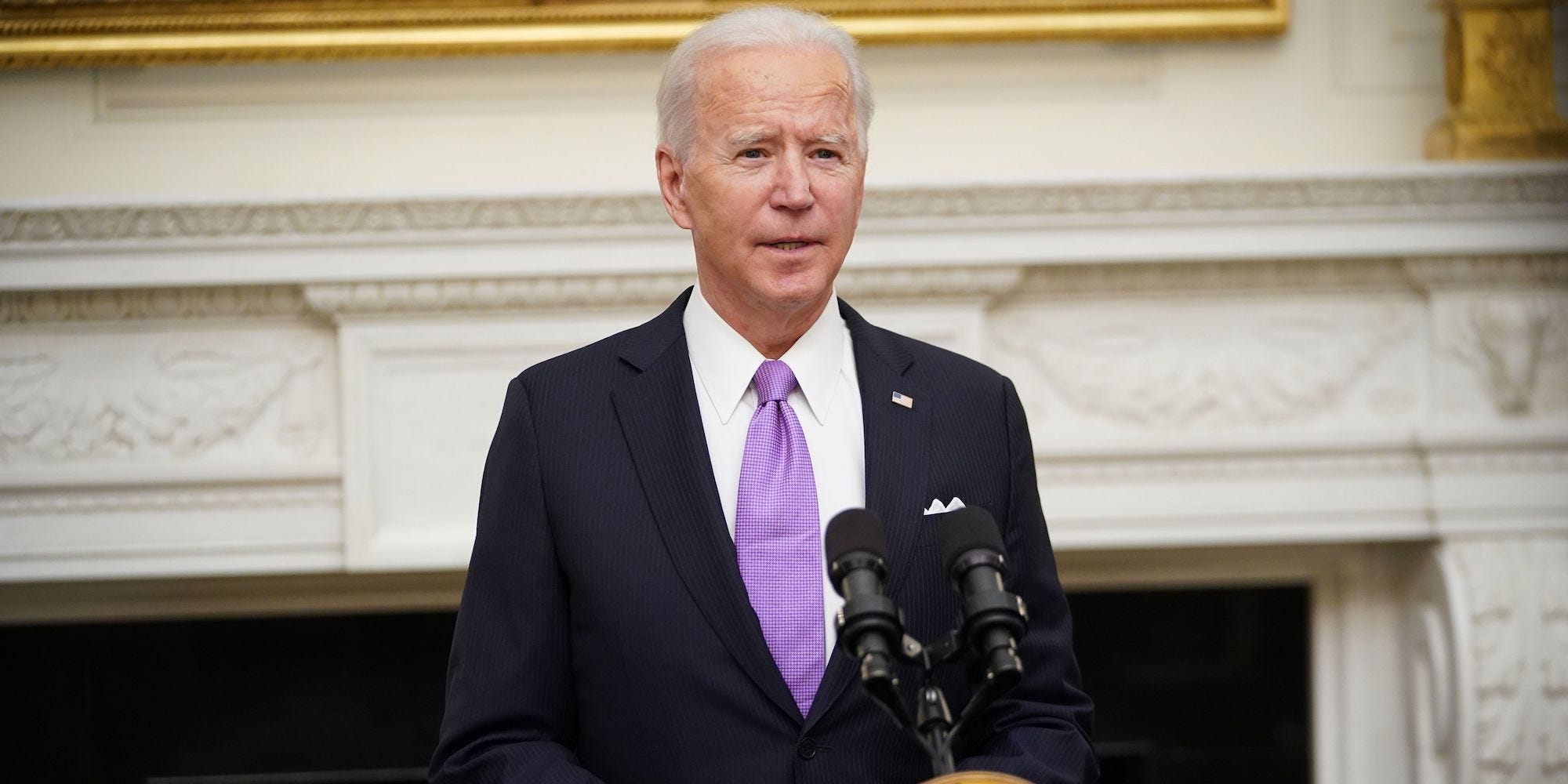

(Photo by MANDEL NGAN/AFP via Getty Images)

- The Penn Wharton Budget Model found that President Joe Biden’s stimulus plan would provide over $3,000 in benefits to the poorest American households.

- The direct stimulus payments, expanding the child tax credit, and expanding the Early Income Tax Credit, would provide direct aid to 99% of the bottom households.

- Spending on the three provisions will increase GDP by about $172 billion, the report found.

- Visit the Business section of Insider for more stories.

President Joe Biden’s $2 trillion stimulus plan would provide over $3,000 in benefits to households in the bottom 40% of incomes, according to the Penn Wharton Budget Model.

In a report released on Wednesday, the Penn Wharton Budget Model found that three provisions of Biden’s stimulus plan – extending the child tax credit, direct stimulus payments, and extending the Earned Income Tax Credit – together would cost $595 billion in 2021 and provide direct aid to 99% of households in the bottom 80% of the income distribution.

“For those in the bottom 20 percent of the income distribution, the direct payments combined with the CTC and EITC expansions alone would boost after-tax incomes by over 50 percent,” the report said.

Biden’s plans to provide $1,400 stimulus checks, along with extending tax credits, continue to be debated by lawmakers and experts. The president on Wednesday indicated that he is willing to compromise on the eligibility – but not the size – of the stimulus payments, which counter the Republican proposal of $1,000 checks.

—President Biden (@POTUS) January 30, 2021

And in terms of the child tax credit, economists have disagreed on the merits of a monthly, fully refundable credit, but Democrats have drafted legislation to issue $300 monthly payments as part of the ongoing pandemic relief efforts.

The report estimated that spending on the three mentioned provisions will increase GDP by about $172 billion, or 0.8%.